Click to see 360° View

LOBBY

DOUBLE HEIGHT INTERIOR

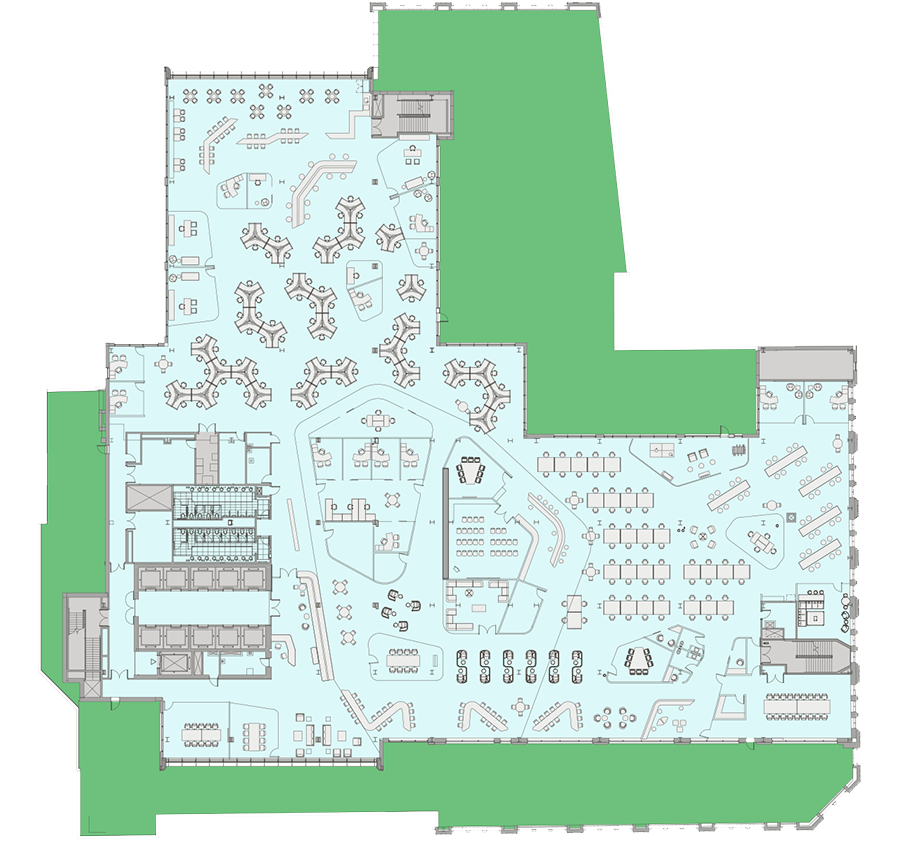

CREATIVE SPACE

ROOF TERRACE

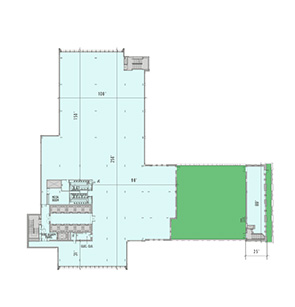

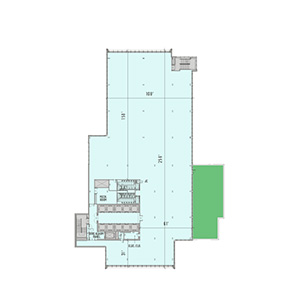

PRIVATE TERRACE

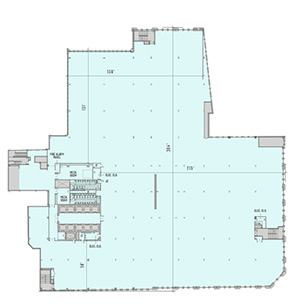

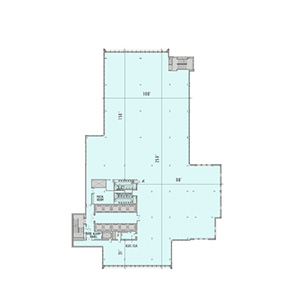

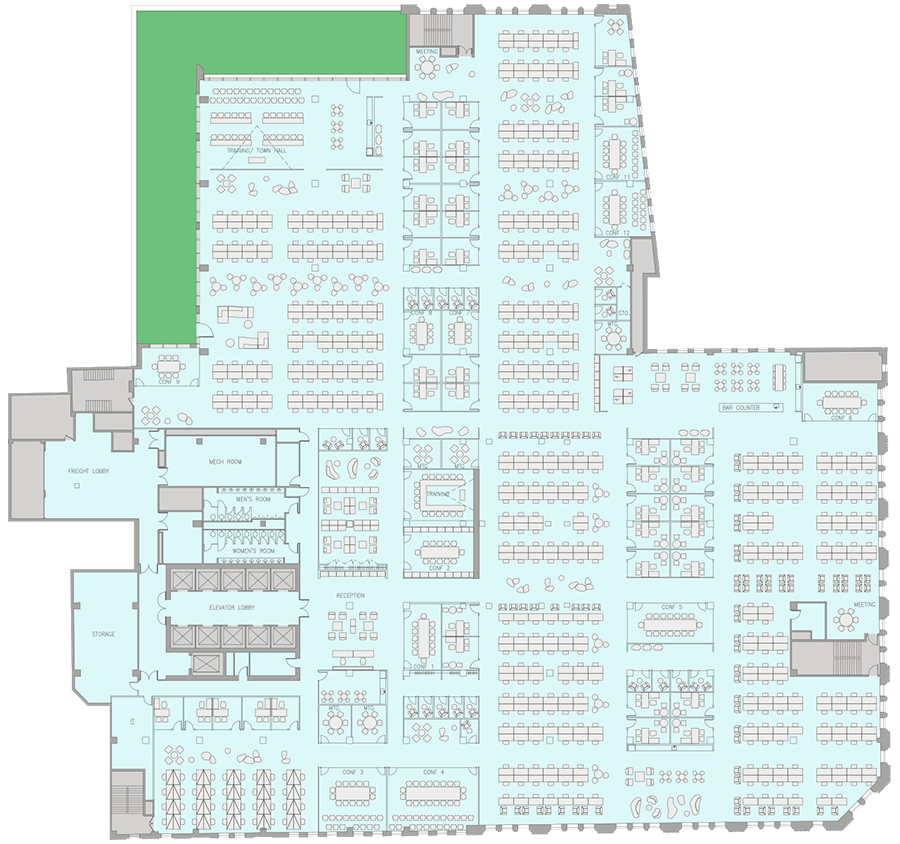

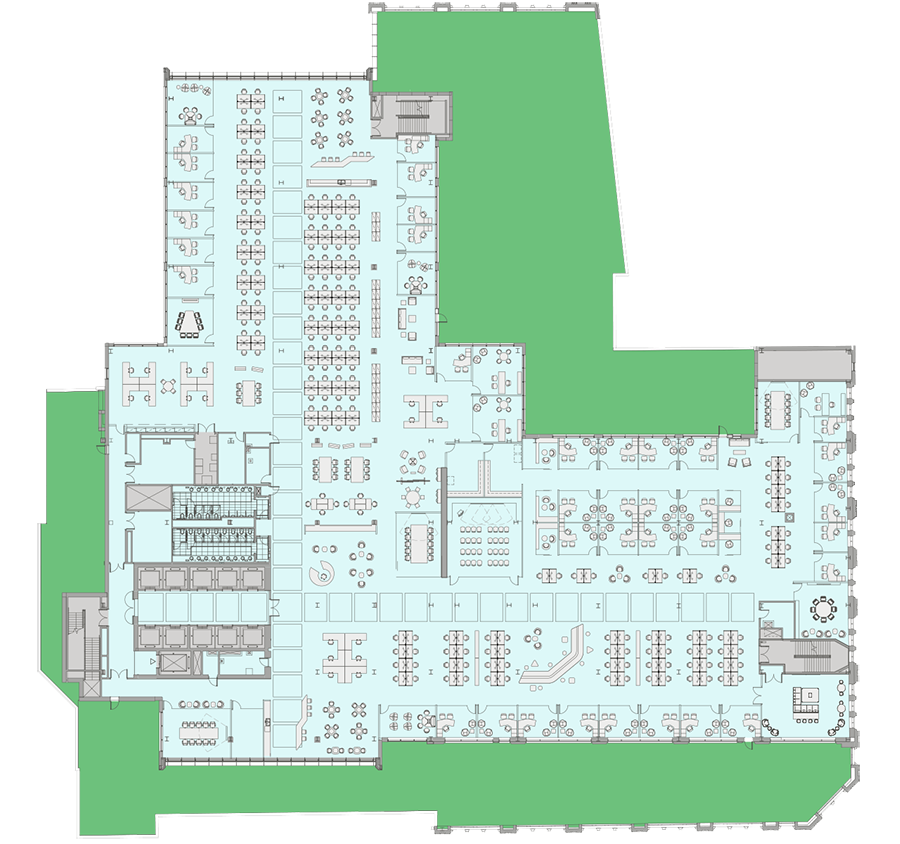

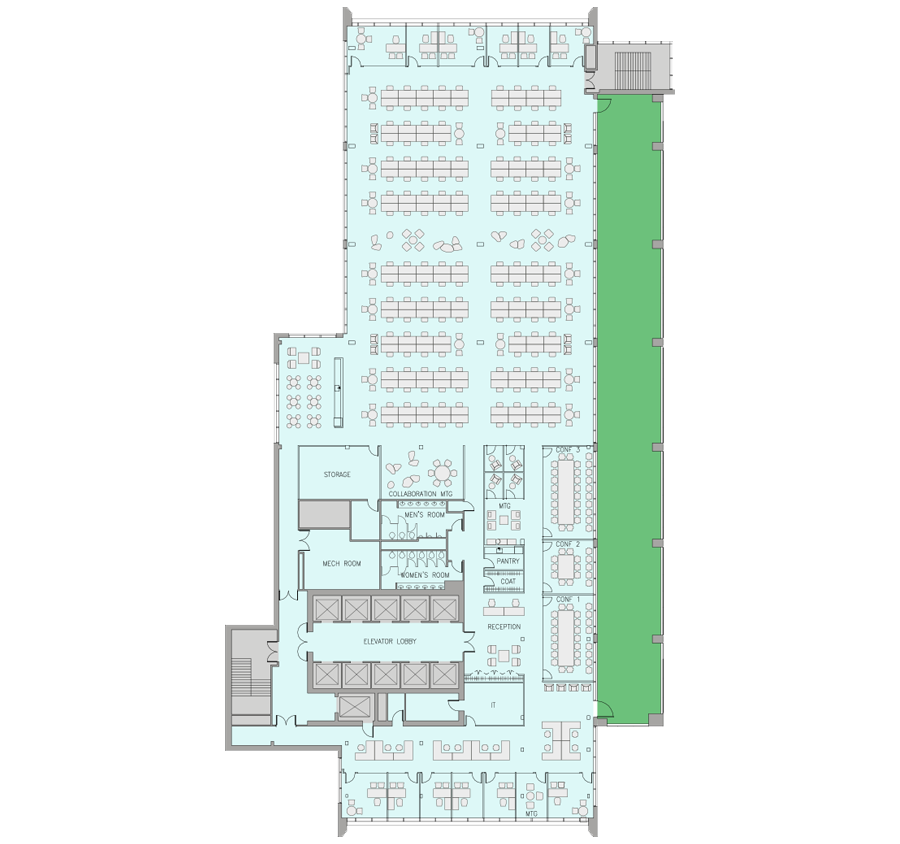

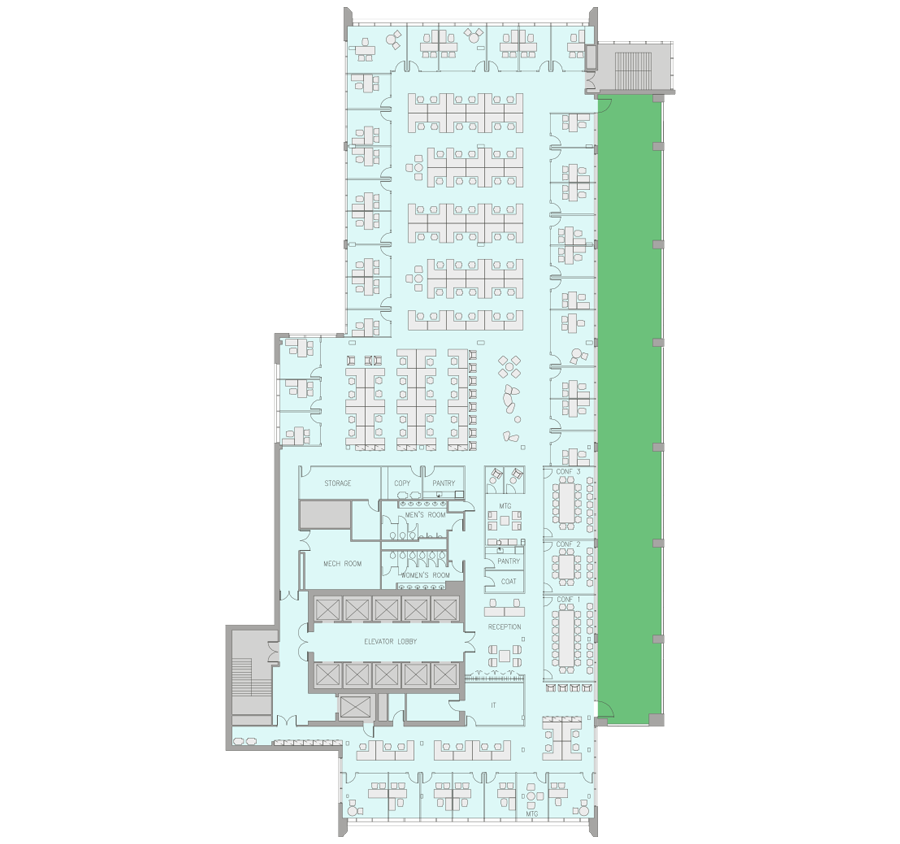

THE LARGEST FLOOR PLATES IN BROOKLYN.

DOWNLOAD FLOORPLANS

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| CONFERENCE | 12 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PHONE ROOMS | 362 |

| TOTAL | 194 |

| CONFERENCE | 12 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PHONE ROOMS | 362 |

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| TOTAL | 194 |

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| CONFERENCE | 12 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PHONE ROOMS | 362 |

| TOTAL | 194 |

| CONFERENCE | 12 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PHONE ROOMS | 362 |

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| TOTAL | 194 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PHONE ROOMS | 362 |

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| CONFERENCE | 12 |

| TOTAL | 194 |

| PHONE ROOMS | 362 |

| ROOMS | 7 |

| MEETING ROOMS | 25 |

| PRIVATE OFFICE | 66 |

| WORKSTATION | 294 |

| RECEPTION | 2 |

| CONFERENCE | 12 |

| TOTAL | 194 |

TO FIND MORE VALUE, LOOK

NO FURTHER.

The abundance of New York City-provided incentives, inlcluding significant tax and energy savings, ultimately drives value that enhances your business and your bottom line.

Tax credit/employee per year—relocation employment and assistance program (reap)

$3,000

No commercial rent tax

35-45% reduction of electric and natural gas cost—energy cost savings program (ecsp)

45%

30-35% reduction on electric delivery—business incentive rate (bir)

35%

| Incentive package/exemption (annual value per rsf) |

Low density (200 SF/Employee) |

HIGH density (120 SF/Employee) |

|---|---|---|

| Relocation employment and assistance program (reap) | $15.00/RSF | 25.00/RSF |

| Energy Cost Savings Program (ESCP) and Business Incentive Rate (BIR) | $1.00/RSF | $1.00/RSF |

| Commercial Rent Tax Exemption (3.9%) | $3.00/RSF | $3.00/RSF |

| ICAP RE Tax Abatement | $6.00/RSF | $6.00/RSF |

| Total annual savings | $25.00/RSF | $35.00/RSF |

Drag for 360° view